Press Room

SAIT Perspective on Smile FM’s Budget 2026 Round‑Up

As South Africa anticipates the tabling of the 2026 National Budget Speech, Smile FM’s latest coverage highlights a wide range of expectations from political parties, business groups and tax experts. Their perspectives underscore the same pressures SAIT has been tracking: rising debt‑service costs, sluggish growth and mounting calls for targeted tax relief.

3-minute read

SARS is coming after these taxpayers hard next month

The South African Revenue Service (SARS) is tightening its enforcement net as it prepares to implement new global reporting standards for digital and cross‑border wealth from 1 March 2026. These developments reflect a significant and inevitable evolution in global tax transparency, one that underscores the growing importance of proactive, well‑informed compliance.

5-minute read

SAIT Welcomes Ruling Strengthening Fair, Evidence‑Based Tax Administration

SAIT has welcomed a recent court judgment, noting that it reinforces fair tax administration and underscores the importance of evidence‑based decision‑making within the tax system. The ruling is seen as a positive step toward greater accountability and transparency in SARS processes.

3-minute read

What is the capital gains tax exclusion on a primary residence?

A recent article unpacks the key technical considerations behind this important relief, including what qualifies as a primary residence, how joint ownership, business use, and special trusts can affect the exemption, and why the exemption may be reduced or lost if the property was not used as a primary residence for the full period of ownership.

The article was reviewed by Professor Keith Engel, SAIT’s CEO, reinforcing SAIT’s role as a trusted institute on complex and evolving tax issues.

At SAIT, technical rigour and expert insight remain at the heart of our contribution to the tax profession, ensuring taxpayers and practitioners alike can navigate the law with confidence.

4-minute read

Sars set to unveil VAT e-invoicing framework this year

SARS, South Africa’s tax authority, plans to unveil a VAT e-invoicing framework in 2026 as part of its VAT Modernisation Programme. This move aims to shift toward digital, real-time tax reporting to curb fraud, streamline compliance, and align with global standards like PEPPOL, with mandatory rollout potentially by 2028 starting with larger taxpayers. The framework builds on prior consultations and draft bills, defining e-invoices as structured electronic documents validated before issuance.

4-minute read

South Africa is standing on the threshold of a system-driven compliance era

As highlighted by SAIT’s Acting Deputy CEO Keitumetse Sesana in the Daily Investor, SARS is rapidly moving toward earlier, richer, and more accurate visibility of business activity, well before VAT returns are even submitted. This shift will significantly increase real-time scrutiny of businesses and place greater emphasis on system readiness and data integrity.

This aligns squarely with SARS’ Modernisation 3.0 journey—accelerating tax administration at the ‘speed of thought’ and moving us closer to a seamless taxpayer experience.

5-minute read

SARS rolls out major reform for multinational tax rules

SAIT’s Acting Deputy CEO, Keitumetse Sesana, joined Ntaoleng Lechela on Business Day TV’s The Close on 13 January 2026, to discuss SARS’ multinational tax reform agenda. The conversation focused on transfer pricing and international tax compliance, highlighting SARS’ Advance Pricing Agreement (APA) capacity-building initiative as a move toward a more structured and sophisticated approach to managing cross-border tax risk.

9-minute audio

SARS set to implement long-awaited APA system, creating more taxation certainty for multinationals

The South African Revenue Service (Sars) is moving ahead with plans to implement an advanced pricing agreement (APA) system this year.

It has been recruiting specialists in the area of transfer pricing, reports Business Day, and is expected to take APA applications from multinational companies from as early as June.

5 minute read

Foreign Pension Tax Relief: What Treasury’s Latest Move Means for South African Retirees

SAIT welcomed the National Treasury’s decision to partially accept the withdrawal of the tax exemption under Section 10(1)(gC)(ii). This provides crucial relief and certainty for South African retirees receiving income from past employment abroad.

The initial proposal would have fully removed the exemption, making foreign retirement benefits like pensions, annuities, and lump sums fully taxable in South Africa. This could have jeopardised the financial stability of thousands who planned retirements based on the current tax framework. In this interview, SAIT’s Acting Deputy CEO, Keitumetse Sesana, examines the National Treasury’s decision and its implications for the South African tax regime, including SAIT’s pivotal role in submitting formal commentary opposing the full repeal.

30-minute audio

South Africa’s recent official removal from the FATF (The Financial Action Task Force’s) Grey Listing

In a radio interview discussion with KC 107.7 FM, SAIT’s Acting Deputy CEO, Keitumetse Sesana, examines South Africa’s official removal from the Financial Action Task Force (FATF) Grey List.

22-minute audio

Warning to influencers selling and promoting fake LV and Gucci bags online

Keitumetse Sesana, SAIT’s acting deputy CEO, told The Citizen that selling and promoting fake designer items is as bad as selling illicit alcohol and cigarettes.

5 minute read

Fake bags, real trouble: SARS warns influencers face jail, fines for luxury dupe promos

Keitumetse Sesana, Acting Deputy CEO at SAIT, explained to News24 the risks influencers take when promoting counterfeit goods, stating that it violates both intellectual property laws and the Counterfeit Goods Act, putting them in both SARS and SAPS bad books, including the original brands themselves.

7 minute read

National Treasury makes u-turn on foreign retirement benefit exemption plans

The National Treasury decided to reconsider its earlier proposal to remove the tax exemption on foreign retirement benefits for South African residents. The initial proposal would have resulted in pensions earned by professionals and retirees from their time working abroad becoming subject to tax in South Africa. In its advocacy efforts, SAIT, expressed concerns that the change could impact the country’s appeal to skilled immigrants and returning expatriates potentially subjecting these groups to forms of taxation from which they were previously exempt. Acting Deputy CEO Keitumetse Sesana, provides insights on the significance of this reversal in this interview with Newsroom Afrika.

5 minute video

Treasury shelves tax on foreign retirement income

SAIT Deputy Acting CEO, Keitumetse Sesana, speaks about Treasury’s reversal on taxing foreign pensions and how balance reform and fiscal foresight could protect South Africa’s economic credibility.

15 minute audio

Treasury intends to scrap exemption next year

The Treasury’s plan to do away with foreign pension tax exemption is under intense scrutiny. Revenue experts are warning that the move could deter wealthy retirees and expatriates from returning home. SAIT CEO, expands on this matter on eNCA.

2 minute video

Tax refund fraud triggers urgent reforms

The Tax Ombud has released a draft report recommending interventions to help curb the hijacking of SARS e-filing profiles. Fraudsters are exploiting system weaknesses to change taxpayer banking details and re-route refunds, often undetected. The ombud is calling for stricter refund verification, automated alerts and extra checks in changes to sensitive profile information. Keitumetse Sesana discusses the matter with eNCA.

4 minute video

True cost of corruption

Shocking corruption at Tembisa Hospital has sparked fresh questions about who benefits from government tenders and at what cost. While politically connected elites cash in, small sub-contractors are left unpaid even decades later. Keitumetse discusses the true cost of corruption on Newzroom Afrika.

4 minute video

Tax for influencers

The South African Revenue Service (Sars) has clarified how social media influencers will be taxed, warning that all forms of income – whether paid in cash, products, services or travel – must be declared. South African Institute of Taxation’s Keitumetse Sesana has more.

16 minute video

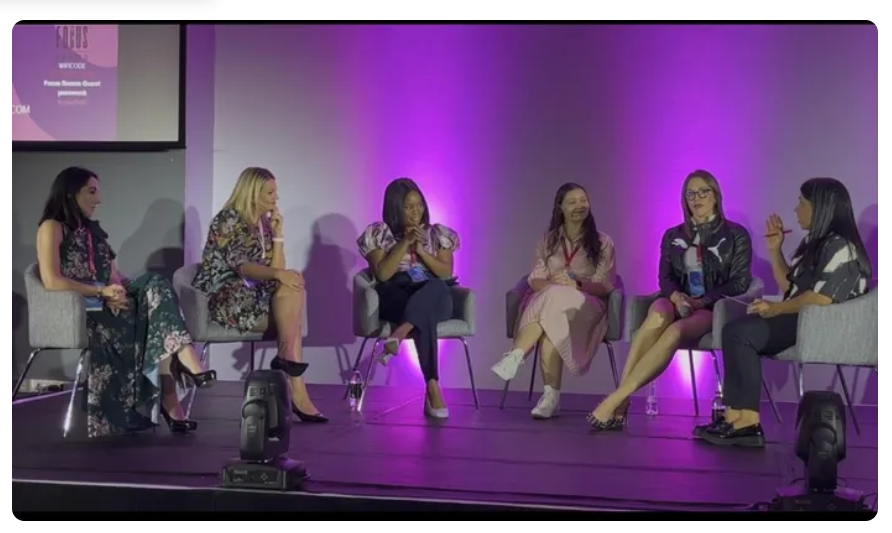

Understanding tax obligations: Insights from the Africa Creator Festival for South African influencers

At the Africa Creator Festival, in Johannesburg, a panel discussion called, The Future of Creator-Brand Partnerships: Trends, Technologies, and the Legalities. (L-R) Amanda Rogaly, founder of Baby Yum Yum.com, Emma Sadleir the Digital Law Company, Keitumetse Sesana Acting Deputy Chief Executive Officer at SAIT, Casey Mantle chair of the IAB South Africa Influencer Marketing Committee, Nicole Capper, General Manager at Humanz and Marchelle Gordon moderator.

6 minute read

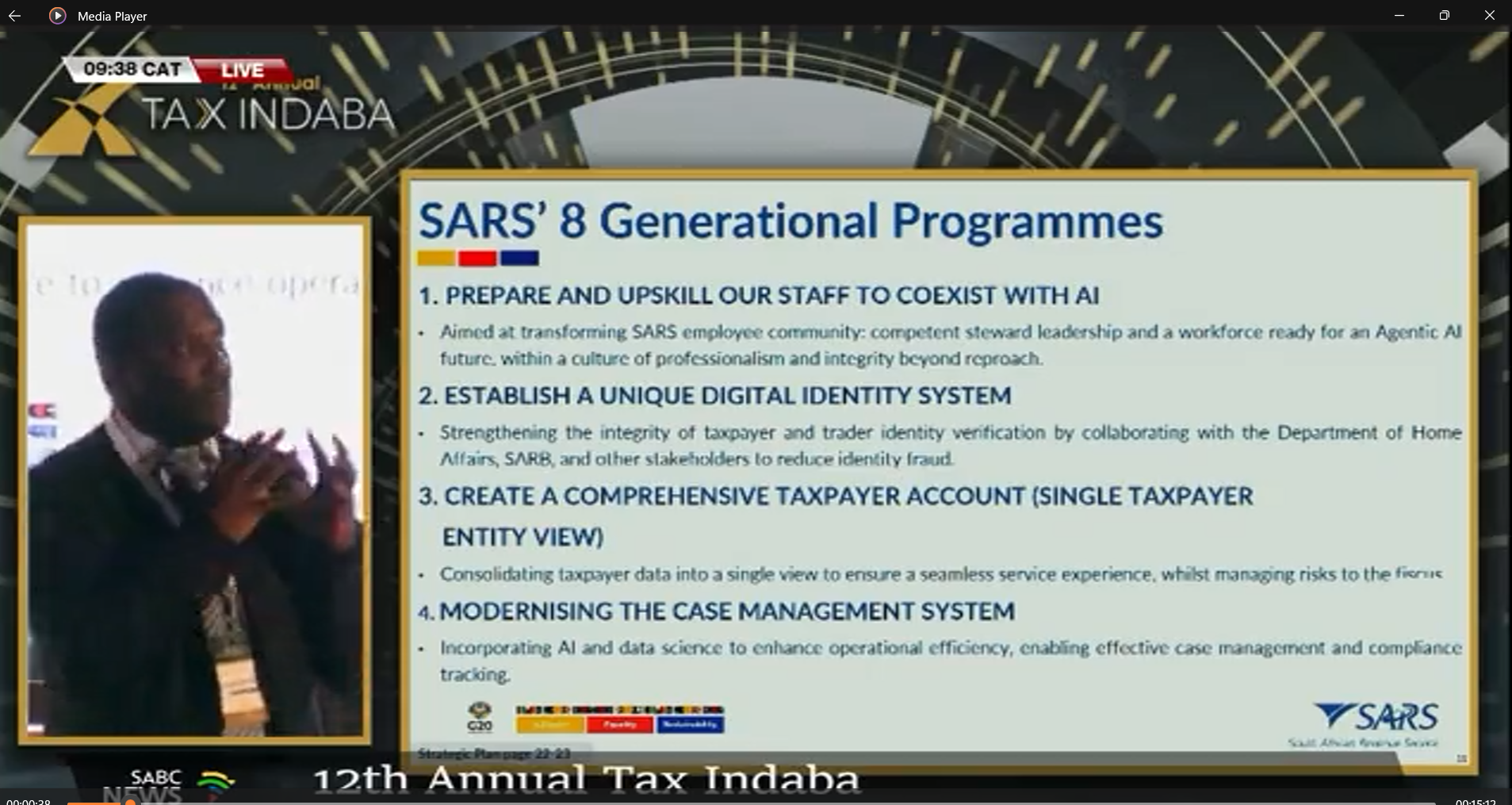

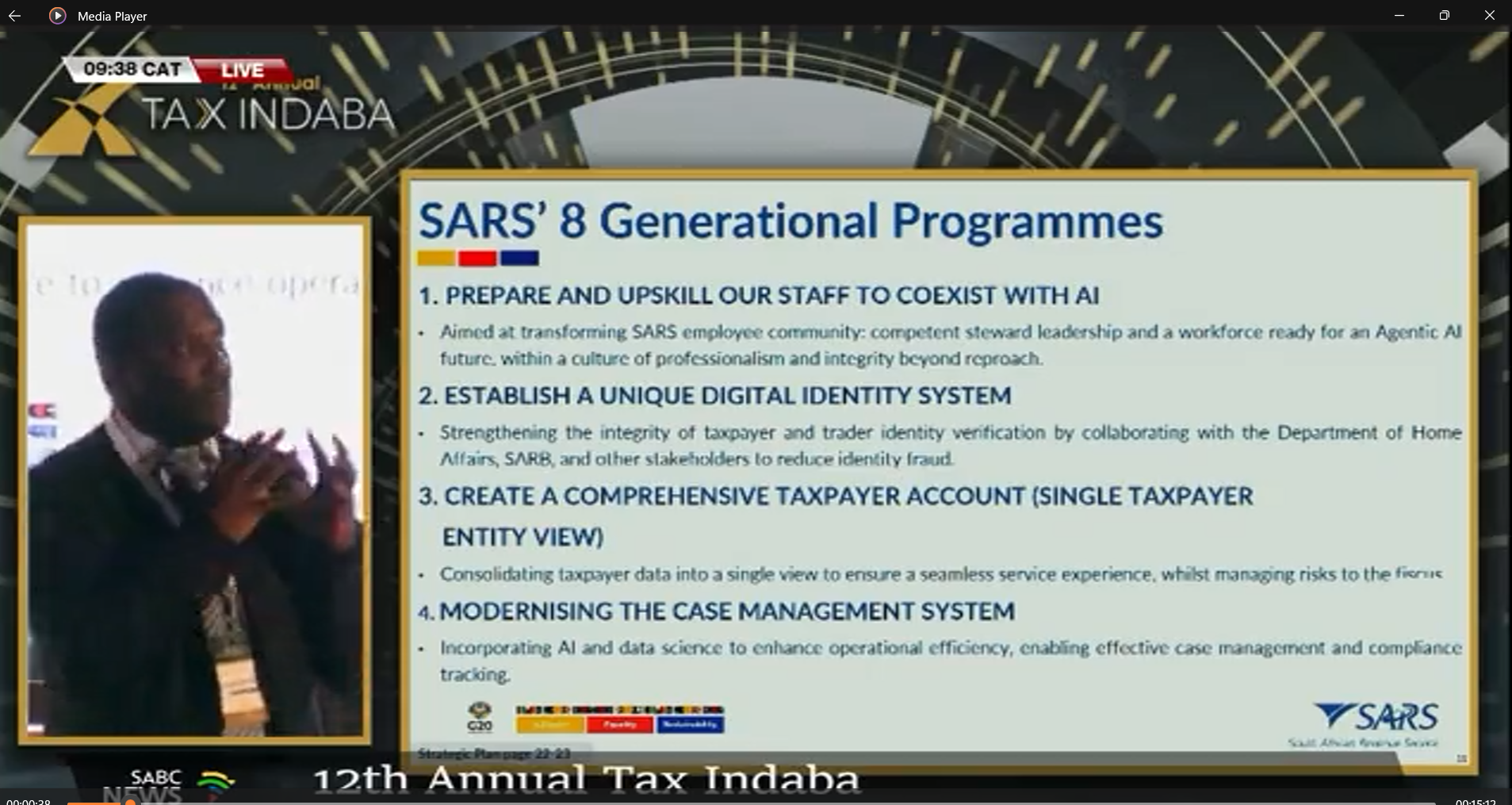

SARS to modernise systems

SARS Deputy Commissioner Johnstone Makhubu has outlined ambitious plans to modernise systems at the 12th South African Institute of Taxation Conference in Boksburg.

1 minute audio

SARS Deputy Commissioner warns of aging workforce

Dr Johnstone Makhubu warns of aging workforce at the 12th Annual Tax Indaba.

1 minute audio

A deeper look into the 1st day of the 12th Annual Tax Indaba

A look at some of the discussions that took place on the first day of the Annual Tax Indaba. Speakers included SARS Deputy Commissioner Dr Johnstone Makhubu and Deputy Finance Minister Ashor Sarupen.

4 minute video

SARS Deputy Commissioner delivers keynote address at the 12th Annual Tax Indaba

Delivering the keynote address at the 12th Annual Tax Indaba, SARS Deputy Commissioner, Dr Johnstone Makhubu, shares the challenges and wins of the revenue service.

16 minute video

SARS Deputy Commissioner speaks Domestic Debt and Reforms at the 12th Annual Tax Indaba

Giving his keynote address at the 12th Annual Tax Indaba, SARS Deputy Commissioner, Dr Johnstone Makhubu, discusses Domestic Debt and Reforms.

5 minute video

Key topics at the Tax Indaba

SAIT’s Keitumetse Sesana discusses the key topics to be discussed at the 12th Annual Tax Indaba.

8 minute video

US tariffs impact

South African business players intimately connected to industries that export goods to the US that are now subject to the 30% import tariffs may be worried about what this means for them. More in this Newzroom Afrika interview with SAIT’s Keitumetse Sesana.

8 min video

What is a travel or car allowance?

This article breaks down what a car allowance is and who can be paid a travel allowance.

7 min read

2025 tax season has arrived: Here’s what you need to know

2025 tax season has arrived: Here’s what you need to know.

7 min read

Navigating the 2025 Tax Season in South Africa: Strategies, Pitfalls, and the Art of Compliance

SAIT and SARS stress the value of verifying credentials before entering into any agreement this filing season.

9 min read

Tax Season is open – be prepared

Acting Deputy CEO Keitumetse Sesana talks all things Tax Season on SMILE FM.

16 min audio

Filing Season Warning by SARS

As the tax season is expected to get underway today, SARS is warning of a rise in fraud. Keitumetse Sesana, Acting Deputy CEO at SAIT weighs in.

2 min video

Tax Season is officially open – What you need to know

Acting Deputy CEO Keitumetse Sesana breaks down Tax Season 2025—key dates, auto-assessments, and how to dodge tax scams with Aldrin Sampear.

11 min video

SAIT Prepares South Africans for the 2025 Tax Season – Here’s What You Need to Know

SAIT’s Editorial and Communication Specialist, Rendani Nwedamutswu, shares tips for this Filing Season and the consequences of non-compliance in this article.

4 min read

Upcoming SARS Personal Tax Window

SAIT’s Acting Deputy CEO joined Connor Robertson on KC107.7 to break down some of the most pressing topics for this year’s Filing Season. From which documents you need to prepare, to the pitfalls of common filing mistakes, and how auto-assessments may affect you—this conversation is packed with insights to help you file with confidence

24 min audio

Guide – Which employees pay PAYE Tax in SA

Understanding your tax duties can be tricky, mainly with Pay As You Earn (PAYE) tax in South Africa. This detailed guide will help you understand employee tax duties. Let’s discover which employees pay PAYE tax.

4 min article

Tshwane universities unite in feasibility research for SA tax clinics project

Tshwane University of Technology (TUT), University of Pretoria (UP) and University of South Africa (Unisa) launched a collaborative research project early in May 2025, to determine the feasibility and sustainability of establishing South African tax clinics to provide free tax education and support to unrepresented taxpayers.

4 min article

SARS turns up the heat on tax dodgers

The taxman is getting a serious financial upgrade from the National Treasury and are investing an extra R4-Billion this financial year on top of the R7,5-Billion already budgeted for the next three years. This is aimed at sharpening the revenue service tools, tightening compliance and hunting down those who still owe the taxman.

2 min 50 second video

Reaction to the national budget 2025

With the last two attempts scuppered by a standoff over VAT hike that has since been scrapped; the estimated revenue shortfall sits at approximately R75BN. Keith Engel, Chief Executive Officer at the South African Institute of Taxation, shares his views.

5 min video

National Budget 3.0

SAIT’s Keitumetse Sesana weighs in on

the budget delivered by Finance Minister Enoch Godongwana.

8 min video

SARS Targets South Africans With Outstanding Tax Debt in Major Collection Drive

SARS Targets South Africans With Outstanding Tax Debt in Major Collection Drive

5 min read

SARS said to be planning ‘AmaBillions’ blitz to collect outstanding tax, plug fiscal hole

SARS said to be planning ‘AmaBillions’ blitz to collect outstanding tax, plug fiscal hole

5 min read

SARS offers more time for VAT hike reversals

Keitumetse Sesana said the VAT increase reversal was good news for businesses, as many were considering absorbing the increase to cushion consumers. But she warned that there needed to be certainty about the court case brought by the DA and EFF challenging the original VAT increase which was still continuing.

6 min read

Reversal of VAT increase. All good?

A discussion with SAIT’s Mabutho Mthembu about the recent withdrawal of the proposed VAT increase.

14 min video

ANC’s Mbalula calls for ‘constructive talks’ for future bills

Mbalula was speaking at a joint media briefing in Sandton, Johannesburg, attended by the 11 political parties who voted in favour of passing the budget with the understanding of possible reforms of the fiscal framework.

3 min read

VAT remains at 15%

In conversation with Professor Keith Engel the Chief Executive Officer for the South African Institute of Tax Professionals to give reaction to the VAT aversion by Finance Minister Enoch Godongwana.

No VAT increase. Is this good for business?

A discussion with the Strategic Lead for Stakeholder Engagement and Legislation at SAIT, Keitumetse Sesana, about the recent withdrawal of the proposed VAT increase. Int: Keitumetse Sesana.

7 min interview

Government’s late VAT hike reversal hits business

The government’s last-minute reversal of the VAT hike sparked criticism, as businesses had already spent millions.

3 min read

Withdrawing the VAT increase is good news for business but…

Last week it was still all systems go for the VAT rate to increase to 15.5% on 1 May 2025. This morning South African businesses and consumers woke up to the news that Finance Minister Enoch Godongwana has withdrawn the proposed increase of 0.5 percentage points.

Urgent court application to halt VAT increase

The High Court in Cape Town is hearing an urgent application to halt a VAT increase brought by the DA and the EFF. Both parties challenge the legality and constitutionality of the hike, announced as part of the revised fiscal framework.

6 minute video

No adjustments in personal income tax and inflation

The National Treasury has decided not to adjust personal income tax brackets and rebates for inflation in the 2025/26 financial year. This may result in a higher tax liability should you receive a salary increase. South African Institute of Taxation’s Keitumetse Sesana explains what this means.

11 minute video

How taxes are killing South Africa’s economy

In this episode of Money, Markets and Masterminds, Citywire South Africa and Keith Engel (pictured below), CEO of the South African Institute of Taxation, break down the true impact of government tax policies. We explore whether the country is pushing past the top of the Laffer Curve, how tax complexity is strangling businesses and the economy, and why endless hikes might do more harm than good.

5 minute read

What is VAT? Keitumetse Sesana breaks it down

What is VAT? SAIT’s Keitumetse Sesana breaks it down.

5 minute read

VAT increases by 0.5 percent point – reaction

A discussion with Keitumetse Sesana of the South African Institute of Taxation, about the 2025 Budget Speech.

9 minute video

What is bracket creep? Keitumetse Sesana tells us more

Bracket creep is a term to describe an increase in taxes that occurs when the marginal tax brackets are not adjusted annually for inflation.

5 minute read

Budget Speech to be delivered tomorrow

Newzroom Afrika presenter discusses the budget speech expectations with Keitumetse Sesana from the South African Institute of Taxation. Watch interview

8 min 26 sec video

Discussions around the contentions VAT increase

As Finance Minister Enoch Godongwana will table his budget speech tomorrow, various sectors including ordinary South Africans will be waiting with baited breath to see if there will be a VAT increase. While some are calling for an increase in the allocation for local government. Also having unions warning government not to renege on the 5.5 percent wage offer that was presented to unions in the public sector. Prof Keith Engel, CEO of the South Africans Institute of Taxation weighs in.

9 min video |

Could we still see a hike in VAT when the budget is tabled?

South Africans may still face an increase in VAT when the revised budget is tabled in March unless the government’s proposed spending plans are revised.

Tax experts share their views at the SAIT post-budget event.

6 min read |

Different types of taxes that we pay

In a conversation with Professor Keith Engel, CEO at the South African Institute of Taxation about the different types of taxes that we pay following the postponement of a budget speech due to the disagreements about the two-percentage point increase in VAT.

24 minute audio

Could we still see a hike in VAT when the budget is tabled?

South Africans may still face an increase in VAT when the revised Budget is tabled in March unless the government’s proposed spending plans are revised. Panelists at the SAIT post-budget event discuss.

5 minute read

Budget speech postponed to March – Keith Engel

The Democratic Alliance said the postponement of the national budget speech is the victory for the people of South Africa as it prevents the implementation of a 2% VAT increase that could severely impacted the country’s economy. To explore this issue joint by South African Institute of Taxation, CEO, Prof. Keith Engel.

1 min 52 second video

2025 Budget Speech has been postponed

The much-awaited 2025 Budget Speech has been postponed. This comes as there have been disagreements within the Government of National Unity over the budget. The Finance Minister Enoch Godongwana has announced that the amended Budget will be announced on March 12. Interview with the North West University Business School Economist Professor Raymond Parsons and The South African Institute of Taxation CEO Professor Keith Engel, on the implications of the Budget Speech being postponed.

18 minute 32 second video

SA Institute of Taxation on budget speech postponement

Discussion about the proposed increase in VAT which derailed the budget speech. The DA had warned it would not vote for such a budget in Parliament. The SA Institute of Taxation CEO Keith Engel comments.

10 minute 8 seconds video

Keith Engel rejects possibility of tax increase

The South African Taxation Institute CEO, Keith Engel has rejected the possibility of a vat increase and his comments comes ahead of Finance Minister’s first budget speech set to be delivered in Cape Town this afternoon, it’s the first under the Government of National Unity.

2 minute 15 seconds watch

Expectations on tax changes

With the 2025 National Budget Speech just a day away, critical tax and economic policy changes will soon be unveiled. Experts believe finance minister Enoch Godongwana will announce a raft of tax adjustments including VAT, personal income tax and corporate tax, to cover the revenue shortfall.

2 minutes and 57 video

SAIT CEO, Keith Engel Shares 2025 Budget Expectations

In an interview on On Point with Liabo Setho, SAIT CEO Keith Engel discussed anticipated tax policy changes ahead of the 2025 National Budget Speech.

6 min read | 7 min video

Protecting Taxpayers: SAIT’s Role in Tackling eFiling Profile Hijacking

In a recent Ilungelo Lako interview on SABC Live, Keitumetse Sesana, SAIT’s Strategic Lead for Stakeholder Engagement and Legislation, joined the Tax Ombud to discuss the rise in digital tax fraud.

1 min read | 2 min 26 sec video

Jeremy’s weekly wrap: Trump’s SA rift, wage hikes and tax forecasts

And then, with Budget 2025 just around the corner, Keith Engel, CEO of the South African Institute of Taxation, joined us to discuss key tax developments.

5 minute read

Understanding the Tax Ombud’s eFiling Security Survey: Insights from SAIT

Keitumetse Sesana joined eNCA’s Uveka Rangappa to discuss the increasing threat of eFiling profile hijacking and how taxpayers can protect themselves.

1 min read | 2 min 26 sec video

Key tax changes in 2025

Understanding if there will be key tax changes in 2025 with Keith Engel, CEO of the South African Institute of Taxation.

5 minute read

SA’s 2025 tax landscape: Risks, compliance and key changes

‘I think the biggest one that people are worried about is the NHI, which would then say goodbye to the medical credits. It’s only a matter of time before medical credits go,’ says Keith Engel, CEO of the South African Institute of Taxation.

7 minute 37 second podcast

SA’s 2025 tax landscape: risks, compliance and key changes

SAIT CEO, Keith Engel, recently sat with Jeremy Maggs of @Moneyweb for an interview discussing SA’s 2025 tax landscape: risks, compliance and key changes.

‘US funding to SA minimal’ – SA government

What impact will a loss of US funding really have on SA? How SA’s labour law can help the Just Energy Transition process and what happens when the pilot can’t fly the plane? SAIT CEO Professor Keith Engel engages with Jeremy Maggs and other guests to deliberate on the matter.

30 minute podcast

Excise taxes on beer – balancing revenue and health

Excise taxes on beer have become a contentious issue, raising concerns about their impact on consumers, producers and the economy. Professor Keith Engel of SAIT shares his views.

5 minute read

Tabling of new fiscal framework

Chief Economist at Econometrix, Dr Azar Jammine and Prof Keith Engel, CEO of the South African Institute of Taxation talk about the implications of the National treasury having to table the new fiscal framework.

8 min 49 second video

SARS gives window for VAT increase reversals

Sars gives window for VAT increase reversals BACKTRACKING

5 min read

Now you see it, now you don’t

In mid-April it was still all systems go for the VAT rate to increase to 15.5% on 1 May 2025. A week later, South African businesses and consumers woke up to the news that Finance Minister Enoch Godongwana had withdrawn the proposed increase of 0.5 percentage points.

3 min read

SARS gives businesses more time for VAT increase reversals

The South African Revenue Service (Sars) has given businesses and service providers that cannot immediately reverse the 15.5% VAT charge an opportunity to do so by May 15.

3 min read

For Press Inquiries

As Featured In: