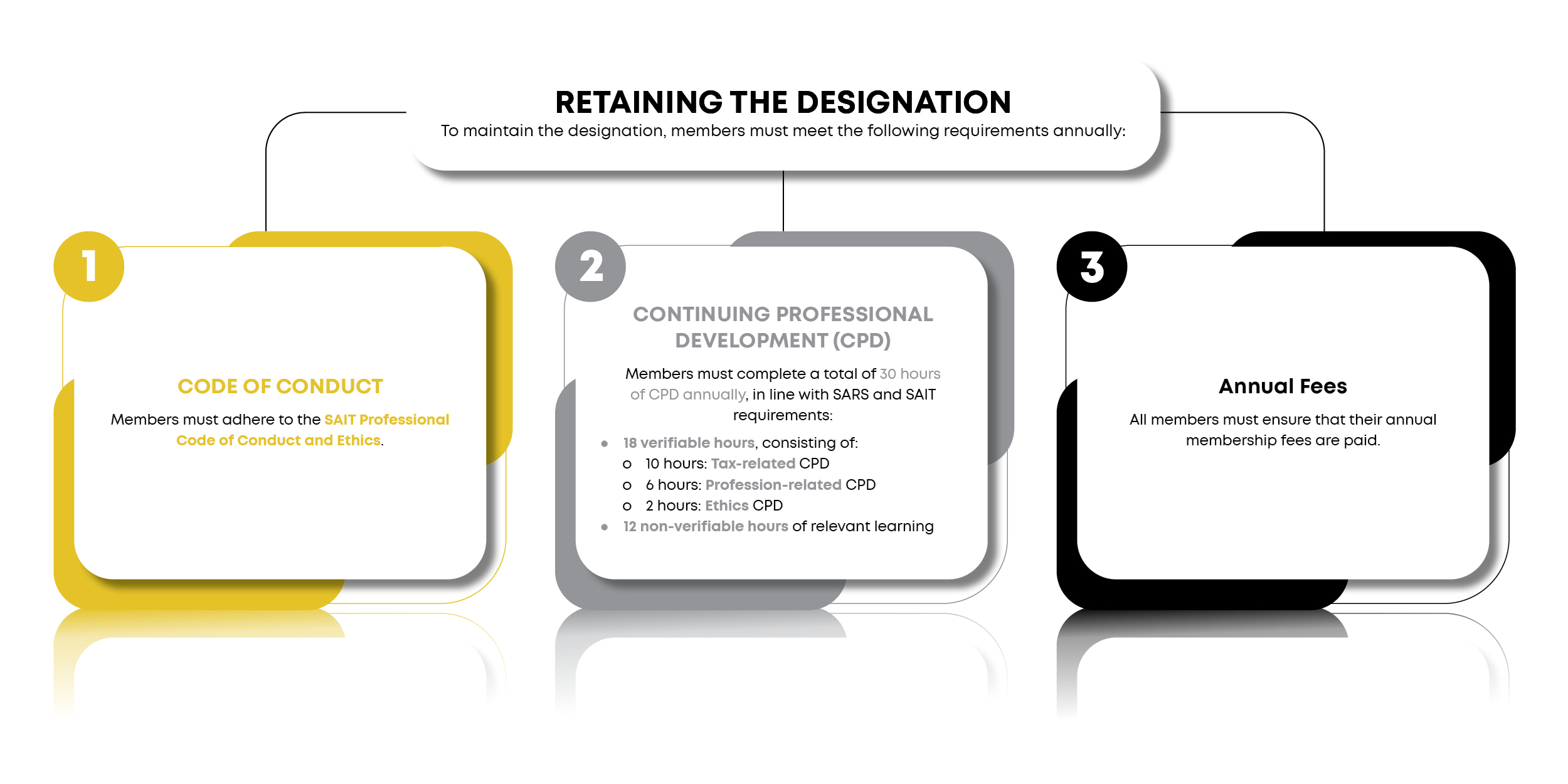

Master Tax Practitioner (MTP(SA))

The Master Tax Practitioner (MTP(SA)) designation is designed for professionals in accounting, law, and finance with advanced tax expertise. MTPs focus on complex tax compliance, advisory, and tax controversy work. Their specialisation includes corporate tax, VAT, international tax, mergers and acquisitions, wealth planning, tax policy, and litigation, typically dealing with large entities.

Awarding Criteria

To be awarded the Master Tax Practitioner designation, applicants must meet the following three core requirements:

Applicants must have completed a National Qualifications Framework (NQF) Level 9 qualification that is either wholly or primarily focused on taxation. Acceptable qualifications typically include a Master’s degree or LLM (Master of Laws) in Taxation, either from South African or international institutions.

Accepted qualification titles at NQF Level 9 include:

- MCom in Taxation

- MAcc in Taxation

- MCom (Accounting) – Taxation

- MPhil in Taxation

- MPhil (Accounting) – Taxation

- LLM – Master of Laws

- LLM – South African Tax Law

- LLM – International Tax Law

- PhD – Tax Policy (accepted in specific cases depending on content focus)

Applicants must have engaged in tax work as their primary or sole activity for at least five (5) consecutive years within the past ten (10) years.

Evidence of this requirement must be submitted in the form of a resume of tax experience, verified by an employer or other senior tax professional.

Applicants must provide SAIT with the following:

- Verified proof of tax work experience

- Proof of an NQF Level 9 qualification, as listed above

- Proof of a clear tax record

- Proof of a clear criminal record

In line with SARS-recognised criteria for Recognised Controlling Bodies (RCBs) and registered tax practitioners, all applicants must complete the SARS Readiness Programme before registering as a tax practitioner.

| Description | Fee Amount | Notes |

|---|---|---|

| Registration Fee | R800.00 | Once off registration fee to process your application |

| Annual Membership Fee | R7 580.00 | Payable within 30 days of approval |

| Monthly Option | 1st, 15th, or 25th of each month | Debit order option available |